Swatch Group: Key Figures 2012

Biel / Bienne (Switzerland), February 4, 2013

- Gross sales increase by one billion to CHF 8 143 million, up 14% on 2011.

- Net income rises 26% to CHF 1 608 million.

- Operating profit amounts to CHF 1 984 million, a rise of 22.9% compared with 2011. Operating margin increases from 23.9% to 25.4%.

- Over 1500 new jobs created, of which approximately 900 in Switzerland.

- Proposed dividend increase of 17.4%, CHF 6.75 per bearer share (2011: CHF 5.75) and CHF 1.35 per registered share (2011: CHF 1.15).

- The 2013 financial year started well in January with continued healthy growth.

Group Overview

In 2012, the Swatch Group exceeded its eight-billion-franc target for gross sales. In an economic environment that remained extremely nervous, the Group increased gross sales by 14.0% to CHF 8 143 million, one billion more than in 2011. Foreign currencies stabilized somewhat against the Swiss franc but remain significantly weaker than two years ago. Had the currency situation been the same as in 2010, sales would have been some CHF 500 million higher in the year under review.

Thanks to a high level of capacity utilization, innovative production methods and traditionally strong cost controls, operating profit increased to CHF 1 984 million, a rise of 22.9% compared to 2011. The operating margin improved from 23.9% to 25.4%. Overall, this resulted in net income of CHF 1 608 million, a rise of 26.0% on 2011.

With equity of CHF 9 344 million and an equity ratio of 83.3%, the Group has an extremely solid and independent financing. The average return on equity was 18.5% (16.8% in 2011). The Group generated an operating cash flow of CHF 999 million, despite further investments in net working capital. In addition, a total of almost CHF 500 million was used for investments. Around 1500 new jobs were created in 2012, thereof 900 in Switzerland, and a further 280 positions were added as a result of acquisitions. This increased the total headcount of the Swatch Group around the world to over 29 700.

The Board of Directors of the Swatch Group will propose the following dividend for 2012 to the Annual General Meeting on 29 May 2013: CHF 6.75 per bearer share and CHF 1.35 per registered share. This increase in the dividend payment to shareholders of 17.4% versus the previous year is due to the good results achieved in 2012 and underscores the continued optimistic outlook for business performance in 2013.

Outlook for 2013

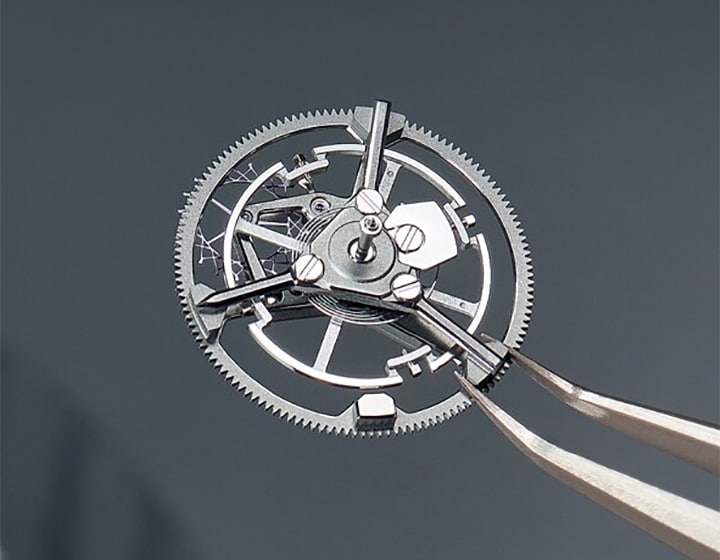

The signals from the markets around the world clearly indicate continued healthy growth potential for the Swiss watch industry and the Swatch Group. As always, the focus is on producing innovative and high-quality Swiss products in every segment. Against this backdrop, there is a realistic prospect of long-term growth in the Swiss watch industry of five to ten percent per year.

The Swatch Group continues to have substantial potential for 2013, thanks also to the integration of Harry Winston to the brand portfolio. With this acquisition, the Swatch Group is present in all segments, including jewelry, with world-renowned, first-class brands with their fully integrated vertical production.

Related news

Proposed appointment of Andreas Rickenbacher to the Board of Directors

Swatch Group will propose the appointment of Mr. Andreas Rickenbacher as a new member of its Board of Directors at the next Annual General Meeting, which takes place on May 12, 2026. This proposal is in line with the Group's desire to strengthen its governance and benefit from additional expertise within its Board of Directors. Andreas…

Key Figures 2025

Net sales of CHF 6 280 million, -1.3% at constant exchange rates compared to the previous year (-5.9% at current rates)1). Negative currency impacts of CHF 308 million. Excellent performance in the second half of the year with sales growth of 4.7% at constant exchange rates. Strong acceleration in the fourth quarter with sales up 7.2% worldwide…

Half-Year Report 2025

Net sales of CHF 3 059 million, -7.1% against the previous year at constant exchange rates and on a comparable basis1) (-10.4% at current rates). Negative currency impact of CHF -113 million. Operating profit of CHF 68 million (previous year: CHF 204 million). Operating margin of 2.2% (previous year: 5.9%). Net income of CHF 17 million (…