Half-Year Report 2016

Half-Year Report 2016

-

Group net sales of CHF 3716 million at current exchange rates, a decrease of 11.4%, or CHF 3666 million, a decrease of 12.5% at constant rates.

- In the Watches & Jewelry segment, including Production, Swatch Group recorded a decrease of 11.3% at current exchange rates.

- Double-digit growth in retail sales in Mainland China and Southeast Asia.

- Hong Kong: retail sales downturn has bottomed out, wholesale remains difficult.

- Operating result of CHF 353 million, 53.6% below the first half of the previous year, due to additional currency shifts, lower production utilization and the long-term industrial strategy of continued investment in the employees, new products and marketing. The operating margin reached 9.5%.

- The Watches & Jewelry segment, including Production, achieved an operating margin of 11.2%.

- Net income of CHF 263 million, 52.0% below the first half 2015. Net margin was 7.1%.

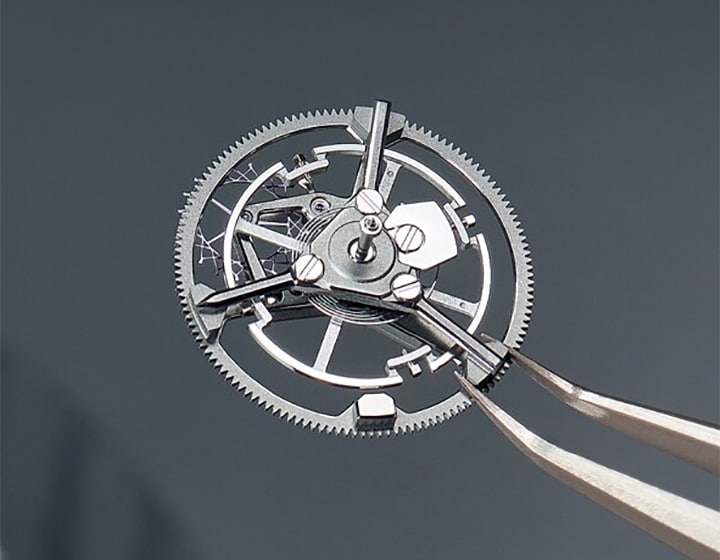

- 60% Swiss made in the watch industry as of 2017 is a clear advantage for Swatch Group, with its verticalized local production base. Inventories have already been increased accordingly in order to meet future demand for Swiss made products.

- Harry Winston with a strong half-year and a record month in June.

- Clear improvement in Mainland China. The first three weeks of July show a very positive development compared to last year, especially in the Luxury and Prestige segment, very strong for Breguet, Blancpain, Glashütte Original, Omega and Longines.

- United Kingdom with a strong July start in the Group’s retail stores, due to the favorable pound sterling. Clear signs of tourism revival in parts of Europe, mainly in Spain and Italy. Additionally, Omega’s engagement in the Olympics in Rio de Janeiro will generate further positive stimulus. Overall clearly a stronger second half-year will be expected.

Outlook second half-year 2016

Swatch Group anticipates clear growth in local currency in the second half of the year compared with the weaker second half of 2015, and thus an annual result closer or equivalent to the previous year. The outlook for the Group, with its unique brand portfolio and its global retail and distribution network, remain good in all regions and segments in local currency. In the mid to long term, there are many more opportunities than risks. In the first three weeks of July, very good growth was achieved in Mainland China compared with the previous year, especially by the luxury and prestige brands Breguet, Blancpain, Glashütte Original, Omega and Longines. Positive developments can be seen in Southeast Asia, too. Also, markets will continue to develop positively in parts of Europe, particularly in Italy, Spain and Great Britain. The situation in France and Belgium will remain difficult. Decisive growth factors in the coming months will be the normalization of tourism in parts of Europe as well as the further positive developments in China. On the other hand, third-party distributors in Hong Kong are still very uneasy, which will cause further delays in reorders. In North America and Japan, growth in local currency will be achievable.

The Olympic Games in Rio de Janeiro, Brazil, will give an additional worldwide boost to the Omega brand, since the brand is the official Games timekeeper and is underway with nine watch models dedicated to the Rio de Janeiro Games. Omega will also launch the new Seamaster Planet Ocean Deep Black models and the Speedmaster Moonphase Master Chronometer in the second half of the year.

The Tissot brand currently accompanies the Tour de France as official timekeeper and is naturally represented by the new model Tour de France T-Race. Through the NBA, the North American professional basketball league and the WNBA, the women’s basketball league, Tissot will also achieve significantly greater international visibility, particularly with the new NBA collection and the Tissot Ballade Silicium Chronometer, the first wristwatch under one thousand francs with a silicium balance spring. Longines will further expand its position specifically in Asian markets with the new Equestrian and Symphonette collections. Swatch started selling its new Touch Zero Two with fan, fitness and timing functions on 7 July, and as of September, the new Sistem 51 Irony will be available as well as the Swatch Token launched in China.

Sales in all brands are supported through significant long-term marketing investment, the extensive retail network and also by the many new product launches in all segments. Since no structural changes were made to the production base and the entire workforce is highly motivated, the Group can rapidly meet increasing demand, also with regard to the new Swiss made. Thanks to the strong vertical integration of the manufacturing chain and the Swiss production base, the new Swissness rule of at least 60% domestic added value is a unique home advantage for the Swatch Group.

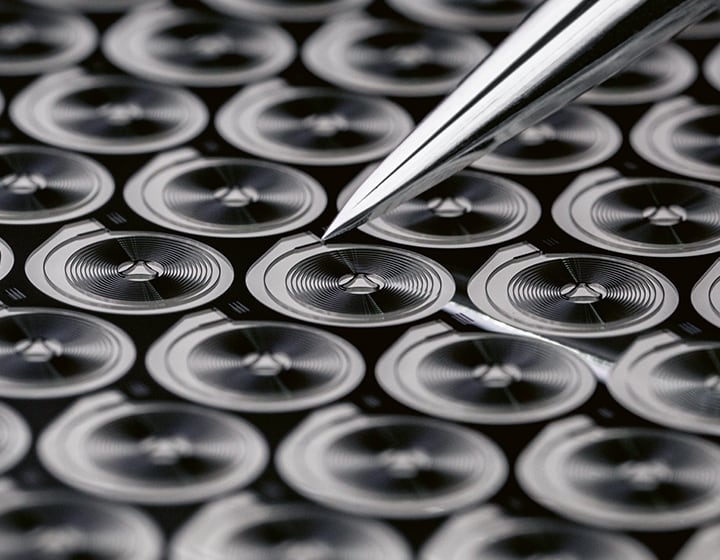

The technology companies, which regularly develop highly innovative electronic products and components, will continue to provide market innovations in the second half of the year. EM Microelectronic-Marin, worldwide leader in the development and manufacture of lowest power ICs, is, for example, working together with ABB on a smart sensor technology for self-monitoring and controlling ABB low-voltage motors used in the most diverse machines and production lines. Renata, in collaboration with Belenos, is already installing the production line for the new batteries, which will be used particularly in the area of electric mobility. Batteries with the new vanadium pentoxide compound for the cathodes and the new electrolyte composition not only have a much higher energy density than previous battery types, but also recharge faster. In addition, they have a longer life and are far safer than well-known lithium batteries. A letter of intent for collaboration with the Chinese automobile and motorcycle manufacturer Geely has already been signed.

![]()

Contacts

Media

Bastien Buss, Corporate Communications, Telephone: +41 32 343 66 80

The Swatch Group SA, Bienne (Suisse)

Email: please use our «Contact Form»

Investors

Felix Knecht, Investor Relations Officer, Telephone: +41 32 343 68 11

The Swatch Group SA, Bienne (Suisse)

Email: please use our «Contact Form»

Related news

Proposed appointment of Andreas Rickenbacher to the Board of Directors

Swatch Group will propose the appointment of Mr. Andreas Rickenbacher as a new member of its Board of Directors at the next Annual General Meeting, which takes place on May 12, 2026. This proposal is in line with the Group's desire to strengthen its governance and benefit from additional expertise within its Board of Directors. Andreas…

Key Figures 2025

Net sales of CHF 6 280 million, -1.3% at constant exchange rates compared to the previous year (-5.9% at current rates)1). Negative currency impacts of CHF 308 million. Excellent performance in the second half of the year with sales growth of 4.7% at constant exchange rates. Strong acceleration in the fourth quarter with sales up 7.2% worldwide…

Half-Year Report 2025

Net sales of CHF 3 059 million, -7.1% against the previous year at constant exchange rates and on a comparable basis1) (-10.4% at current rates). Negative currency impact of CHF -113 million. Operating profit of CHF 68 million (previous year: CHF 204 million). Operating margin of 2.2% (previous year: 5.9%). Net income of CHF 17 million (…