Massagio de la Presidente

Questo messaggio non è disponibile in italiano. Voglia consultare la versione inglese (qui di seguito). Traduzione in tedesco e in francese.

![]()

Message from the Chair

Message from the Chair – Address of Nayla Hayek, Chair of the Board of Directors of the Swatch Group, to the 2014 General Assembly of the Swatch Group Shareholders on May 14, 2014, at the Velodrome, Neumattstrasse 25, Grenchen, Switzerland.

The spoken word in German is valid.

![]()

Dear Madam, Dear Sir, Dear Fellow Shareholders,

We are very pleased to be able to hold our General Assembly in Grenchen for the first time, particularly because, as the home of several of ETA’s production facilities, it is so important for us and for the entire watch industry. Today we are in a Velodrome, normally seen as a place for sprints. Unfortunately that won’t be the case today. This meeting will, in fact, be a marathon and we will certainly have the longest General Assembly in the history of Swatch Group. We regret it but unfortunately, we can’t change it.

I am pleased that we are again altogether in one building. By starting the General Assembly 45 minutes earlier, I remain hopeful that we can finish, as planned, by lunchtime instead of dinner time.

I will try to keep my remarks as brief as possible.

Once again, we have selected a special watch for you. A 1970s banknote. A watch which will not be offered for sale. A note for you alone.

Swatch Group is the name of the multi-faceted company that we all jointly own. The fact that it was Swatch that gave its name to our company is no coincidence. Thirty-one years ago, the launch of Swatch saved the Swiss watchmaking industry. On the occasion of its 30th birthday, which we celebrated with a number of events in 2013, Swatch finally reached adulthood. Despite this, it has not in any way lost its joyous dimension, or its spontaneity, or its creativity. It may no longer entirely be the enfant terrible it was in the 1980s, but the landscape of the watchmaking industry is inconceivable without it. And as Swatch Group, we acknowledge our debt to the Swatch every day.

However, exactly what we owe to the Swatch is not that easy to describe. Allow me to approach the issue both from my standpoints as Chair of the Swatch Group Board of Directors, and as the person responsible for our most recent acquisition, the brand Harry Winston.

What we as a company owe to the Swatch is, above all, the salvation of the Swiss watchmaking sector. Without it, without this emotional product that has been an enormous success worldwide, we would never have achieved this recovery. This solid foundation has enabled us once again to make the world aware of our country’s qualities and values. We have revived enthusiasm for timepieces made in Switzerland. We have attracted attention through emotion. Thanks to the creativity, the irony, the beauty and very importantly, the affordable aspect of an everyday product, we have repositioned Switzerland and one of its traditional industries on the international scene. We have also, we daresay, radically rejuvenated this industrial sector. This success has enabled us, with considerable commitment and hard work, to reestablish our prestigious brands, to reposition them and finally, to build a solid business success with them. Certainly there are some shareholders among you who remember the sorry state that brands like Omega, Longines and Tissot, for example, were in at the beginning of the 1980s. In the meantime, they have become heroes of the Swiss watchmaking industry, inspiring universal passion and respect.

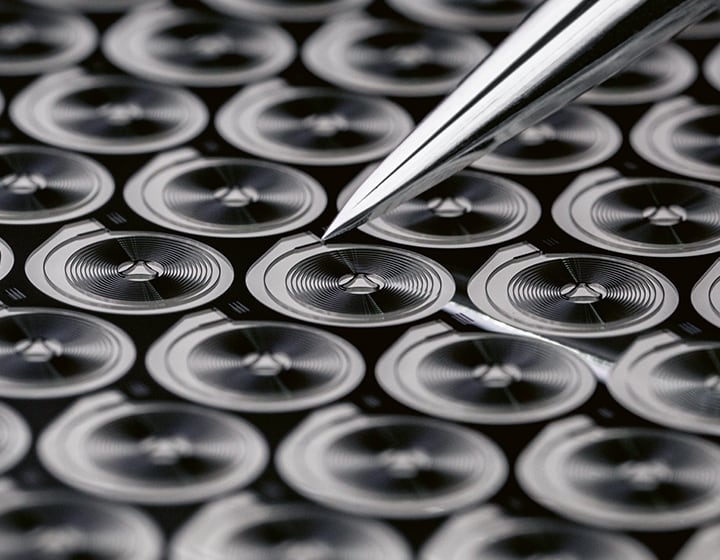

The Swatch is also responsible for another radical change that is just as important, albeit less visible. It is essentially on an industrial level that the watchmaking industry was saved. To produce a watch with only 51 parts, to put hundreds of different variations on the market every year, to provide artists with the chance to create a «canvas on the wrist», a philosophy had to be developed that was able to deal with basic concepts such as machines, automation, robotics and design. The Swatch SISTEM51 that we launched in Switzerland in December 2013 and which now available worldwide is an emblematic example of this philosophy.

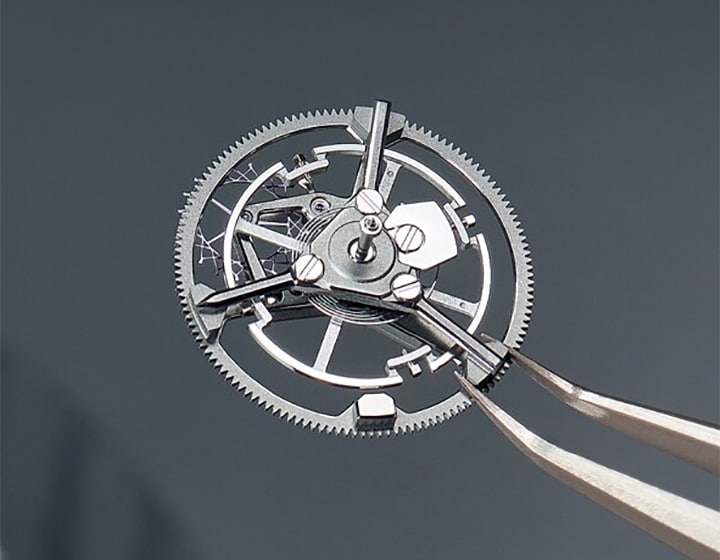

This change did not only make it possible to create an incredible number of jobs, thus consolidating the position as a hub of Swiss industry; it did not only save professions – which today are undoubtedly different but are nonetheless secured; it did not only spark a strong drive towards new technologies. Over and above all of that, it radically supported our vision of our products and our activities. Today, a Breguet, a Blancpain, a Jaquet Droz, a Glashütte Original – to name just a few examples of classic masterpieces of the art of watchmaking – would be unthinkable without the most recent technologies, such as silicon balance springs, state-of-the-art materials, alloys and ceramics, as well as the production of tiny components using special machines or robots. All of these developments are only possible – and can only be financed – within the framework of a highly efficient, innovative industry at the peak of modernity and within the context of an industry that pays such close attention to finding qualified employees, training them and enabling them to develop, motivating them and ultimately, retaining them.

At Swatch Group, our social responsibility is not merely a personnel issue. Environmental, ethical and social criteria are integral parts of our procurement policy. The responsible purchase of industry-specific resources such as precious metals, diamonds and exotic leathers is a priority for the Group. And remember: Swatch Group was the first and, to date, almost the only luxury goods producer to strictly regulate its use of exotic leathers. We chose to use, exclusively, skins from alligator mississippiensis from the USA and thus have comprehensive knowledge and traceability of leather goods from exotic breeds. Furthermore, Swatch Group decided voluntarily to forgo the use of threatened tree species and to use only wood from sustainable species. This has allowed the companies of Swatch Group to make another significant contribution to the ecological balance. Swatch Group encourages its suppliers to guarantee that they deliver precious metals from ethical sources and that these originate in conflict-free regions and meet all of the legal requirements throughout the entire procurement chain. We also make sure that the diamonds used in our products come only from suppliers that respect and use the Kimberly Process certification system completely. This means that at Swatch Group there are no so-called blood diamonds or conflict diamonds whose revenues finance violent conflicts.

Swatch Group is also a major player in the field of philanthropy, a fact that is not always communicated to the general public. But we can mention Omega’s partnership with Orbis, an organization whose «Flying Eye Hospital» delivers high-quality ophthalmological care to some of the world’s poorest regions. We can also talk about Harry Winston with its work in the area of pediatrics and Blancpain for its engagement in endangered underwater oceanic territories. We also work with Médecins sans frontières (Doctors without borders), an organization that is active in conflict zones, and with the Theodora Foundation, whose clowns bring happiness to sick children in hospitals; our support goes without mention on the title pages of tabloids. To name but a few.

The Swatch led us on this path from which we will not swerve, and we will continue to look after the hub of Swiss industry and fight for it.

And yet, we bought Harry Winston! An American company with, of course, watch production in Switzerland. With Harry Winston, we are entering another realm – a realm which, thanks to our prestige watches, we already know a lot about: the world of luxury, the world of exclusivity, the world of rarity, the world of the exceptional. But with Harry Winston, we are also adding a dimension that was lacking in Swatch Group until now. With Harry Winston, we are no longer talking about products, or more precisely objects, which can only be produced through human ingenuity. With Harry Winston, we are talking about elements of nature that are so rare, that require such exceptional conditions to take shape and to find their way to us, they are almost inconceivable. With Harry Winston, we are dealing with the unique.

With Harry Winston, we are creating a link in the very heart of Swatch Group with absolutely exceptional natural elements. Until now, we have primarily produced tiny or extraordinary watch movements that work with springs or batteries as their power source. With Harry Winston, Swatch Group is taking on elements of nature that are going to be split, shaped, polished and finally mounted with the sole objective of enhancing their unique beauty and that of the people who wear them.

As you know, diamond is an immensely hard substance. So let’s take a look at some hard facts. In 2013, Swatch Group recorded 8.3% growth and achieved gross sales of 8.817 billion Swiss francs, despite the extremely unfavorable exchange rates. In the second half of the year, gross sales were negatively affected by more than 100 million. In 2013, operating profit grew by 17.0% to reach 2.314 billion, corresponding to an operating margin of 27.4% and net income was 1.928 billion, which corresponds to a 22.8% net margin. By the end of December 2013, equity reached a new high of 9.574 billion Swiss francs, which equates to an equity ratio of 82.3%.

The Harry Winston brand was taken over early in the year and, together with its global workforce of 535 at the time and its Geneva production company, was integrated into Swatch Group. At the end of November, Swatch Group also took control of Rivoli Group in Dubai, a corporation with a distribution network of more than 360 retail stores in the Middle East. Swatch Group had already been a shareholder of Rivoli Group since 2008.

Specific investment enabled production capacities to be expanded further and put into operation. Furthermore, the new production units began operating at the start of the year in Grenchen, Villeret and Boncourt (JU), once again confirming the importance of Swiss manufacturing and the reinforcement of «Swiss Made». More than 900 jobs were created in Switzerland alone.

On the strength of the good results achieved in 2013 and the positive outlook for 2014, the Board of Directors of Swatch Group proposes the following dividend for 2013 to the Annual General Meeting on 14 May 2014: CHF 7.50 per bearer share and CHF 1.50 per registered share. I would particularly like to extend my thanks today to the Board of Directors, the Executive Group Management Board and the Extended Group Management Board, as well as to all our 33 600 employees in Switzerland and around the world, who make Swatch Group a company with many and brilliant facets, a company that is a true diamond! And of course I also wish to thank our shareholders, without whom this diamond would never have become a part of the family.

Thank you very much!

Notizie correlate

Proposta di nomina di Andreas Rickenbacher nel Consiglio di amministrazione

Swatch Group propone la nomina di Andreas Rickenbacher quale nuovo membro del Consiglio di amministrazione in occasione della prossima Assemblea generale ordinaria, che si terrà il 12 maggio 2026. Questa proposta rientra nella volontà di rafforzare la governance del Gruppo e di avvalersi di competenze complementari all'interno del suo Consiglio di…

Cifre principali 2025

Fatturato netto di CHF 6 280 milioni, -1.3% a tassi di cambio costanti rispetto all’esercizio precedente (-5.9% ai tassi attuali)1). L’effetto valutario negativo è stato di CHF 308 milioni. Eccellente performance nel secondo semestre con una crescita delle vendite di 4.7% a tassi di cambio costanti. Forte accelerazione nel quarto trimestre…

Rapporto semestrale 2025

Fatturato netto di CHF 3 059 milioni, -7.1% rispetto all’esercizio precedente, a tassi costanti e su base comparabile1) (-10.4% ai tassi attuali). L’effetto valutario negativo è stato di CHF -113 milioni. Utile operativo pari a CHF 68 milioni (esercizio precedente: CHF 204 milioni). Margine operativo pari al 2.2% (esercizio precedente: 5.9…