Comunicato

Questo comunicato non è disponibile in italiano. Voglia consultare la versione inglese (qui di seguito), o la versione francese o tedesca.

![]()

Biel / Bienne (Switzerland), October 27, 2016

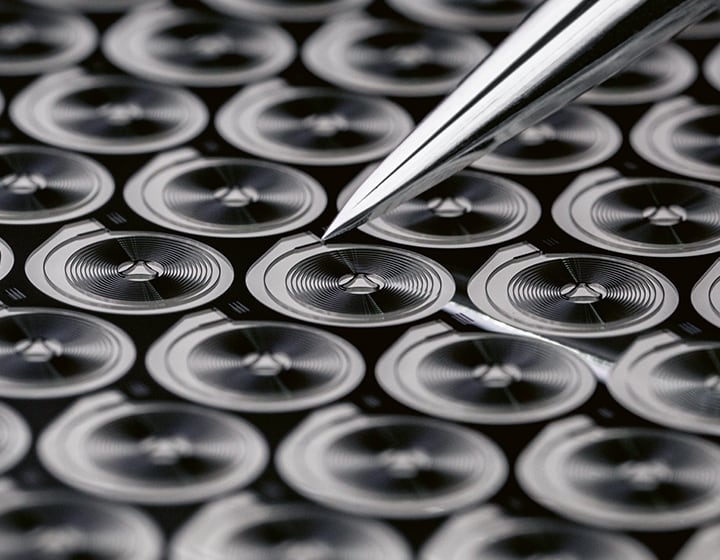

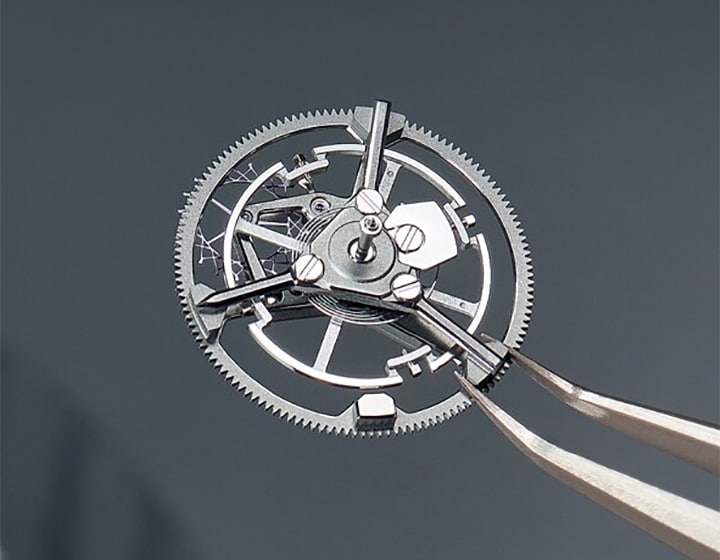

Based on the amicable settlement between Swatch Group and the Competition Commission (Comco), which was signed in 2013, the company ETA has a supply obligation towards third-party customers until the end of 2019. The supply quantity agreed upon has - by a substantial amount – not been purchased by these third-party customers, and certain major customers did not place any orders for 2017, while ETA, due to its imposed supply obligation, must continue to maintain the capacity to deliver roughly 1.5 million mechanical movements. Therefore, Swatch Group requested from Comco that ETA should be allowed to offer and sell the non-purchased quantities to all its third-party customers. The Swatch Group proposal never intended to deviate from the amicable settlement but rather to supplement it in order to take the abusive customer behavior into account. This request has been rejected by Comco.

Swatch Group regrets Comco’s decision and deems it utterly unrealistic. Swatch Group is forced to maintain the production capacities for third-party customers – with substantial financial and personnel expenditures – although in some cases, the third-party customers have drastically reduced or even completely dropped their order quantities. With this decision, ETA and Swatch Group must once again assume their customers’ economic risk. In spite of the fact that major customers such as Sellita or Tudor have reduced their order quantities for 2017 by about 700,000 pieces in total relative to the previous year and although the difference between the effectively-ordered quantities and the spare capacity amounts to almost 900,000 pieces, ETA must maintain the determined capacities for the coming years in order to meet its supply obligation as defined by Comco. As a result, the decision of the Comco penalizes a market participant – ETA – which has made substantial investments in innovation and development of industrial capacity, while other market participants again preferred to focus their investments solely on marketing their products. In order to cover the additional costs arising from this enforced readiness to deliver, ETA will have to consider massive price hikes.

The Swatch Group Ltd

Notizie correlate

Proposta di nomina di Andreas Rickenbacher nel Consiglio di amministrazione

Swatch Group propone la nomina di Andreas Rickenbacher quale nuovo membro del Consiglio di amministrazione in occasione della prossima Assemblea generale ordinaria, che si terrà il 12 maggio 2026. Questa proposta rientra nella volontà di rafforzare la governance del Gruppo e di avvalersi di competenze complementari all'interno del suo Consiglio di…

Cifre principali 2025

Fatturato netto di CHF 6 280 milioni, -1.3% a tassi di cambio costanti rispetto all’esercizio precedente (-5.9% ai tassi attuali)1). L’effetto valutario negativo è stato di CHF 308 milioni. Eccellente performance nel secondo semestre con una crescita delle vendite di 4.7% a tassi di cambio costanti. Forte accelerazione nel quarto trimestre…

Rapporto semestrale 2025

Fatturato netto di CHF 3 059 milioni, -7.1% rispetto all’esercizio precedente, a tassi costanti e su base comparabile1) (-10.4% ai tassi attuali). L’effetto valutario negativo è stato di CHF -113 milioni. Utile operativo pari a CHF 68 milioni (esercizio precedente: CHF 204 milioni). Margine operativo pari al 2.2% (esercizio precedente: 5.9…