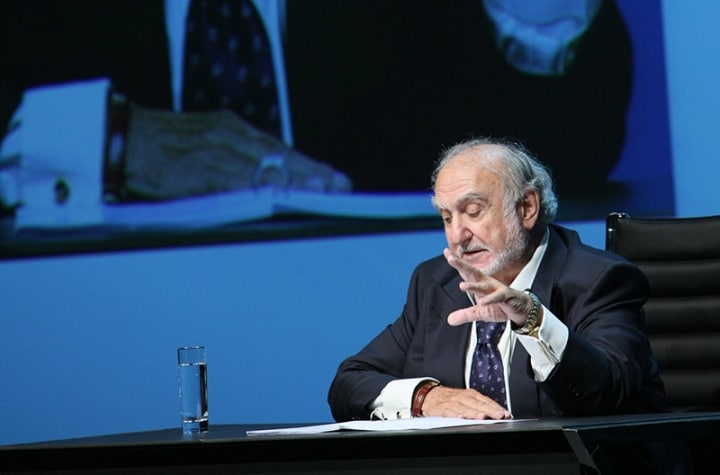

«Economy Day» of the Swiss Business Federation (economiesuisse)

Nicolas G. Hayek calls for more innovation and fundamental reforms of the financial system

Nicolas G. Hayek gave a thought-provoking speech on September 5, 2008 in the Swiss city of Baden on the occasion of «Economy Day»at the Swiss Business Federation economiesuisse. The original version of the speech is in German. Translations into English (see below), French and Italian.

The responsibility of Swiss entrepreneurs in a globalized world

Ladies and gentlemen

The theme of today’s event is «Innovation – an entrepreneurial duty?». With this in mind, I want to share with you my message about the role and responsibilities of Swiss entrepreneurs in a globalized world.

The main obligation of an entrepeneur is, of course, to innovate. However, as we will see, the word «innovation» can be interpreted rather widely. It calls for sound and constructive conditions so that an entrepreneur can help promote prosperity. But what exactly is an entrepreneur?

1. In my opinion, and contrary to popular belief, an entrepreneur is not simply someone who owns a company. Far from it. I believe, entrepreneurs are people whose entire habits of mind and ways of thinking are permeated by entrepreneurial qualities. All of us can have entrepreneurial mentalities – whether we are farmers or journalists, carpenters or lawyers, milkmen or civil servants, bankers or painters (Picasso was an entrepreneur), professors or students or, naturally enough, industrialists.

Entrepreneurs are first and foremost imaginative and innovative artists – with highly developed communication skills, curious about new ideas, able to reflect critically on themselves and on the society in which they live, fascinated by beauty and extremely sensitive to the fate of our planet. This mentality not only allows the entrepreneur to create new products and jobs – in other words real value and prosperity for us all – it is also absolutely essential for the imagination and courage it takes to overcome obstacles.

In fact, the only obstacles which cannot be overcome or avoided are death and taxes!

An entrepreneur also has to be capable of calling into question our society, our rules and what we take for granted. He has to be a rebel, without turning into an enemy, and at the same time must develop a passionate love for a society that despite all its faults, which we all know can be corrected with a human touch here or there, is really worth cherishing.

All of us here, and every person in the world is just such a person – someone who is born with a gift of innovation, imagination and sensitivity from day one. I really do believe that. Think back to when you were six years old. We all played in the sand, had great fun building sandcastles and palaces, gave our imaginations full rein, firmly believed in so many wonderful legends, beautiful princesses and fairy tale kings, and even in Santa Claus.

There are some people who weren’t able to defend themselves against social pressures and who blindly accepted the rules of our society and they have largely lost this imagination. Society at large, school, the army, our training, our jobs all have played a part in extinguishing this spirit of innovation, this creativity and healthily critical view of society in many of us. And that is why I have been saying to my colleagues, staff and friends for years that they should all try to keep the sense of fantasy they had when they were six years old.

Already after founding my first company there’s always one thing I do when setting up a new one: I get together with various – mainly product development – employees for a discussion in which I convince them of their ability to develop creativity. I arouse their innovative powers, their perhaps dormant imagination and encourage them to set themselves unusual objectives and go their ways in perhaps unexpected directions. In my work with renowned research institutions I, myself, also look for new and unusual routes to achieve, what on the face of it, are seemingly impossible objectives and products. The physicist permanently confronted with the minutest invisible particles and processes, with mysterious and gigantic universe of galaxies billions of light years away, is able to develop the wonder and amazement it takes to believe in Santa Claus – or at least not to rule out entriely the possibility of his existence – despite the lack of encouragement a physicist’s technical training may appear to give. This is why physicists have always been and remain my privileged partners in innovation.

After I took over as the chief executive of the luxury brand, Breguet, I organized a brainstorming session with around 35 watchmakers, engineers and product developers. At the end of the day we together had produced more than 40 real ideas – not new designs, optically new models or new colors – but ideas! Genuinely new technical innovations! We are working on putting these ideas into practice for several years. This is a tremendously rewarding experience for me. Not so much because I feel particularly innovative but because it is a wonderful experience to see how my staff members develop – some are more innovative than I am! But that is by no means all.

2. Entrepreneurs must also be capable of dealing with risk and have the courage to take action quickly and consistently. As soon as ideas have been created and a decision taken, they need to be put into effect as soon as possible. Implementation is the most difficult aspect of creativity. During my lifetime, I have been told time and time again: «Don’t do it, it can’t possibly work». It is during the implementation (let’s say getting the job done) phase that entrepreneurs have to overcome most obstacles – be they human or material in nature – and exhibit the kinds of dynamism and vitality that inspires everyone working on the project.

3. Entrepreneurs must be ready and willing to serve people and society at large. And I really do mean serve. Entrepreneurs must take genuine pleasure in seeing that their work makes the people around them happy. Their task is to create or help produce new jobs, prosperity and real material, moral and intellectual values. Entrepreneurs are co-architects of the wealth and social progress of a large number of people, and yes, if possible of everyone.

4. An entrepreneur must use all the resources he has to do everything possible to improve our environment.

He should realize that as a passenger on «spaceship Earth» he must help keep this spaceship in perfect operating condition.

5. Entrepreneurs must not adopt a strategy of fast or, worse still, immediate profit maximization but must have their sights set on long-term, future-oriented sustainable development, such as investing in training and education, research, development and production, even if this means a narrower profit margin in the short term.

6. An entrepreneur must also be a role model to motivate his employees and colleagues. A sense of honor is one of the most outstanding entrepreneurial qualities. Entrepreneurs should not misuse their power thus killing their motivation capabilities and are honor bound to use their abilities to encourage and bring people together to develop them in the most equitable manner possible. These skills also include modesty…I mention modesty because an entrepreneur should never ever forget that he is only a tiny little being on an even tinier planet – Spaceship Earth – in a huge universe. The mission of entrepreneurs must be to convey an atmosphere and mentality of human warmth and optimism to the people around them, to create an environment which encourages and gives confidence to employees in a society in which so many people feel isolated and without roots.

7. Last but not least, the most important qualities an entrepreneur must have are passion, enthusiasm and love for his work. In fact, an entrepreneur doesn’t really see himself as working at all – he’s enjoying himself. If he doesn’t have any fun, he is hardly likely to become a good and successful entrepreneur.

All these important qualities (and several more perhaps less crucial ones as well) are what go towards making a good and successful entrepreneur. As you can see, people with this mindset may have the most diverse of professions and functions – whether they are the owner of a company or not.

Some of you will no doubt consider this catalog of highly positive characteristics as being rather idealistic, utopian or even totally unrealistic. But then there are exactly many such people who have helped shape the Switzerland of today! And many of them continue to do so, although we might say there are not enough of them at the present time.

Eleven years ago, on September 12, 1997, I had the honor and pleasure of addressing the then general assembly of the Swiss Federation of Trade and Industry – called Vorort – today’s Swiss Businsss Federation (economiesuisse), in Zurich on what I considered the important role which entrepreneurs had to play in Switzerland. It was at the time a wonderful Switzerland which was nonetheless struggling with a number of uncertainties and moral crises. Since then, the world has undergone some seismic changes – in fact, it has taken on some totally new forms which have not always been for the better:

- Pioneering technical improvements in the field of communications, particularly the Internet, now mean that every event, picture and idea can be communicated right across our planet in a matter of seconds; our world has become much smaller and increasingly engulfed by a wave of globalization.

- At the beginning of the 21st century we viewed with horror the murderous warlike terrorist attacks in the heart of the United States, in New York and Washington D.C. – events which were without precedent in the history of the US. After them, we knew that the world would never be the same again.

- We witnessed a much harsher approach to human rights, including a clear failure of respect for such rights by truly established democratic nations.

- Wars broke out in Afghanistan, in Iraq and other parts of the world, and there was a worldwide fight against terrorism.

- At the same time, we have experienced the breathtakingly rapid emergence of global economic powers in the east, including China, India, Singapore, South Korea, and also Russia.

- We saw a huge increase in the prosperity and economic influence of many oil-producing countries.

- Europe expanded massively to take on, to begin with, ten new member states – without asking the people of Europe concerned. It was very probably against the will of many Europeans as the subsequent votes in France, the Netherlands and later on Ireland showed and this did not exactly reinforce Europe’s credibility as a model democracy in comparison with small Switzerland.

- Europe is also about to – or has already – superseded the US as the number one world economic power, while the status of the US as the world’s preeminent military power remains intact.

- Switzerland suffered the painful loss of its national airline Swissair – a model company built up by Swiss pioneers and destroyed by the lack of real entrepreneurs at the company’s helm.

- We continue to experience worsening environmental problems which, however, assume now a far larger importance in people’s awareness than ever before.

-

And, finally, there is the first major financial crisis we are experiencing at the beginning of the 21st century. This crisis is in the process of annihilating wealth on a gigantic scale through no fault of the real economy or industrialists and without any sensible measures being visible to control a sector of the financial economy which is run and lauded by just a handful of people.

During the 20th century we have experienced eight considerable and destructive financial crises.

Innovation – yes please! But let’s have innovation in a framework that is conducive to exactly that – innovation. We do not need that values that has been created by the real and production economy to be regularly destroyed by such crises.

The financial crisis

Switzerland is home to a strong financial sector which is either working very successfully or generating enormous losses.

The financial sector is no negligible part of the overall Swiss economy – on the contrary, from the time of its establishment right through to the middle of the 20th century – and still to some extent today – it has played a role that has been wonderfully positive and efficient. The financial sector has done wonders for Switzerland’s growth – railways, the Gotthard tunnel, infrastructure, industrialization – and has brought us all huge benefits and positive developments in as much as it has cultivated and respected Swiss values of diligence and care, as well as fairness and honesty. As a result, Switzerland enjoys a large amount of trust throughout the world.

Towards the middle and end of the last century, however, a large part of the Swiss financial sector sadly began modeling itself ever more slavishly without too much thought on the norms and practices of Anglo-Saxon stock and financial markets – in fact, this trend has picked up increasing speed over the last ten years. This distinctive stock market, financial and money mentality is having a powerfully oppressive and destructive impact on the culture of industry.

While money is, of course, an important tool for an entrepreneur, it cannot be the sole objective when striving to create new value, new jobs and products – in other words, in creating a positive future for us all. The stock exchange plays a crucially positive role for the economy in providing money to the industry if it’s needed. The stock exchange is therefore a strong pillar of industry growth. However, this new stock market and financial mentality knows only one objective – that is to make money, more money and even more money, as much as possible, whatever the costs. This behavior has a very destructive effect on industry.

Don’t get me wrong: there is no doubt that Anglo-Saxon culture and mentality have enriched our world with many overwhelmingly positive and outstanding developments in countless different fields – whether in the arts, sciences, economy, electronics and computer science, physics, medicine or contribution in the creation of a charter of human rights and the strengthening of democracy, to name but a few areas. But the exasperating finance mentality which unfortunately dominates the American and, to some extent, English stock exchanges, with their two-faced governance acrobats, with their hypocritical false lip-service, endless financial sermons, glut of speculators, gamblers and money-grabbing fund operators, Pharisees only too eager to point out the non-existent splinters in the eyes of others whilst ignoring the blemishes in their own, are no help whatsoever to industry, or indeed to the American or even world economy as a whole.

Luckily it is only a small minority – but we have to say a minority which is rather too large – of swindlers and tricksters who play on these otherwise so «puritanically» regulated markets!

Several problems today confront entrepreneurs in large listed companies:

1. Destructive co-proprietors

The new and massive development of anonymous groups and collectors of gigantic amounts of liquidity in global funds, international hedge funds, finance companies, etc. whose financial managers for the most past have little or no entrepreneurial experience and who have never seriously been committed to anything other than money is a very worrying phenomenon. That is extremely hazardous for the future of our global prosperity.

We have witnessed a lot of excesses recently. There is not enough time today to discuss what the speculators in food and raw materials are doing. Let’s say that by buying up large numbers of shares in industrial firms on the stock market, these funds are able to acquire huge influence in companies while vehemently pursuing only their own, short-term interests which – as has become apparent time and again – are sometimes flagrantly at odds with those of the company [in which they have invested]. Specifically, these investors may force companies to sacrifice the future of their businesses for immediate cash. This is another area in which regulatory action is necessary. After all, no one forces us to sell apartments in our residential estates as a matter of course to anyone who wants to buy them.

No foreign resident and tax payer, no matter how important, automatically obtains voting and election rights in our communities, towns, cantons and at the federal level. But this is exactly what happens today in the case of listed companies.

Rules need to be worked out which restrict buying to investors who know and have trust in the company, its products, objectives and culture. Another avenue which might be explored would be to make the purchase of certain shares subject to the agreement of the other shareholders.

While comparable legislation in a number of areas is already in place, recent developments in Switzerland have shown that it is not particularly helpful, as it does not prevent large blocks of shares being sold under evasion of regulations and laws with the benevolent help of honorable financial institutions.

There is an urgent need to improve this dramatic situation and to put a stop to the systematic destruction of future development and innovation. The way to control this is not to create a thousand new control mechanisms and regulations and then to waste reams and reams of paper. None of this will have any impact without fundamental reform which ensures with financial also genuine entrepreneurial control of the financial market system. It is precisely in the markets that are most rigorously and exclusively controlled by paragraphs, publications, rules and regulations and which enjoy a degree of transparency that we have witnessed large excesses and mistakes as well as illicit and damaging actions, to say nothing of the tons of paper wasted unnecessarily.

Annual reports and publications

Publishing annual reports or official information in accordance with all the legal and stock market regulations takes up a huge amount of time and involves vast numbers of people – employees, lawyers and auditors – all of whom endeavor to comply with the relevant rules.

Paragraphs, sections, clauses ... rules, regulations and endless reams of paper.

If archaeologists decide to excavate the sites of our factories in the year 5000, they will surely believe that all we ever built were huge paper mills.

All of this not only uses up a great deal of paper, it also wastes an enormous amount of time and money.

2. Transparency and data protection

Listed companies are required to publish their sales figures in great detail, broken down according to products and countries. This data is more useful to competitors at home and abroad – who do not publish any figures of their own at all – than it is to the shareholders themselves. We must find a solution to this dilemma which ensures that data which – if disclosed – could be damaging for a company does not need to be published everywhere but needs only be shown to a special shareholders’ commission, for example.

You may remember all the fuss caused a few months ago in Italy in April 2008 when a list detailing the incomes and taxes of practically everyone in the country was published on the Internet – a list which, let’s not forget it, anyone could have asked to look at anyway. A huge kafuffle was made about the «scandalously illegal publication», people called for all the data to be deleted immediately, the data protection watchdog was dragged in and the whole affair provoked a huge outcry throughout Italy.

And yet we entrepreneurs – we who actually help create a large part of society’s wealth and prosperity – simply sit helplessly, resigned, saying and doing nothing but conceding defeat whenever we are asked to cheerfully publish all the documents we have about salaries, profit sharing, bonuses, stock options and other information – not only about the company’s top man or woman, but also about large groups of our senior executives.

How would you feel as an entrepreneur if you were accused of being little better than a looter, someone who has parasitically enriched himself at the expense of others, just because you earn one hundred or two hundred times as much as your company’s lowest wage-earners for whom – let’s not forget – you have created work? And at the same time, stars such as Ronaldo or David Beckham, who earn many thousands times the salaries paid to footballers at the beginning of their careers, are celebrated as heroes.

There is no doubt that some company bosses in Switzerland have gone way over the top with their excessive salaries, exorbitant bonuses and stock options – but this applies to only a tiny minority of entrepreneurs. The thousands and thousands of modest and reasonable company heads are seemingly forgotten. We all agree that shareholders should know what the managers of «their companies» are being paid. But instead of publishing the figures in all the newspapers and commenting on them on radio and television – not without a certain malicious undertone – a group of shareholders appointed by the annual shareholders’ meeting could just as well inspect the relevant documents at any time and be empowered to submit their opinions to the annual meeting. Widespread publicity is not only damaging to the company and its employees, it also fails to combat abuses which, on the contrary, simply get entirely out of hand in other areas:

- How do you respond when many people – including your neighbors, friends and acquaintances – respond to such statements with envy? When your children are confronted with comments from other children about their mother’s or father’s salary at school? When you receive regular begging letters – such as the one from a woman and her partner – a couple after all with two incomes – asking you to pick up the partner’s dentist’s bill because otherwise they will not be able to take the – not exactly cheap – holiday trip they had planned abroad this year? Or the letter from this young man who had never been in the Caribbean with his parents and would now like to spend a sabbatical year there with his family at your expense?

- When you spend years providing substantial help and assistance in areas where you know it is needed and are then confronted by this mentality and such correspondence, you will appreciate that you would rather work in a company which is not required to publish its figures. Whether they are located in China, India, Switzerland or any other industrial country – competitors who are not listed on any stock exchange would welcome you with open arms.

The transparency of salaries and other data can be guaranteed at all times even if the figures are not given extensive media coverage and commented on by all and sundry. The way to solve this problem and guarantee such transparency is to set up a committee of shareholders which is empowered to inspect the relevant documents.

3. Analysis and recommendations from Wyoming to Zurich

There are, of course, many gifted analysts working on the stock markets in New York, London and in Zurich – not all of whom suffer «hormonal surges» as one newspaper put it. But there are also quite a few other less talented analysts who only see what is immediately obvious – and sometimes don’t even get that right – and who appear to have no idea or do not want to know about future opportunities. Analysts have an attractive but not a protected profession. Financial or stock market analysts do not require any official legitimization to practice their profession. The training required for the profession should also include entrepreneurial elements and the definition of the profession should not be left entirely in the hands of the banks.

The experiences of recent decades as well as various respectable newspaper articles show us that some financial analysts are sometimes worse than crystal ball-gazing fortunetellers when it comes to accuracy – a problem that is causing huge problems for us here in Switzerland! If, for example, the blades of grass in a governor’s garden back home in Oklahoma or Wyoming fail to grow in line with the «holy» expectations of the analysts, the value of our shares falls through the floor despite our company generating fantastic results and having glowing prospects. Or if analysts’ expectations are disappointed by the number of honeymoon trips to the Niagara Falls in the last three-month period, then a total crash in share prices on the New York and Swiss stock markets is practically inevitable!

And those are just some of the problems confronting entrepreneurs. As I do not have any debts and my own shareholdings are not being used anywhere else as security, I am fairly immune to fluctuations over a few days, or even very much longer, in the value of my shares as long as our company is doing well and the prospects for future growth are outstanding. However, we have many other small shareholders who do suffer from the ups and downs in share prices. And then there are our pension funds and all the values here which are based on their stock market valuation – I’m talking about the billions and billions which include AVS (insurance for the aged and surviving dependants) for millions of Swiss citizens! We are talking about developments which will have a direct impact on such benefits and consequently on each and every one of us.

One potential solution which was suggested to me by a banker was the idea of a «road show». Instead of managing my company, I would be better advised to spend my time traveling to the various stock market centers around the world – to London, Stockholm, New York, or Timbuktu – to convince people that my shares deserve to trade at a higher price. My apparently shocking and outrageous response – that I sell watches and not shares – left him flabbergasted, believing that I had gone completely mad…

An entrepreneur must manage in the long-term interests of his company and must pursue strategies which are right for the company instead of trying to keep stock investors and traders happy in the short term. In my view, stock market prices are anything but reliable guides to the true value of our company, as some unfortunately short-sighted journalists are intent on believing.

Matters are made worse by an zealous, ignorant press which, lacking real expertise or any other reliable yardsticks, make analysts’ statements appear credible to the wider reading public. Analysts and their expectations are exalted into the be-all and end-all of all business and stock market journalism.

This is where a knowledgeable, powerful and neutral control function would have a role to play, regularly checking the accuracy of analysts’ statements and recommendations. This would help to protect investors better against superficial recommendations – some of them have written to me to say how cheated they feel at times by the present system and some analysts. At the same time such a body would also help to ensure that value which has been created by industry is not destroyed by ignorance, by conflicts of interest, by generalizations and by mixing in aspects from completely different parts of the planet.

We should also remember that although small Switzerland only has a population of 7.5 million it is nonetheless both an economic power and – even if not all of you here today quite believe it – an important moral force in the world. Most people around the world consider Switzerland the only country which has a genuine direct democracy. I have already mentioned how the EU with its role model democracy failed to ask the people of Europe whether ten new member states should be allowed to join or not – EU politicians quite simply took the decision for them. That would have been unthinkable in Switzerland. Regardless of the cynicism of certain critics I contend that Switzerland is the most fully developed of all democracies in which the will of the country’s citizens is respected and people have a genuine and equal say in the matters that affect them.

All the larger countries of the world, and particularly the newly industrialized countries China, India, the Arab countries, South America and Africa, as well as in Europe and the US, also look at Switzerland as the nation which has never possessed any colonies. Even the smallest European countries, such as Belgium, the Netherlands or Portugal were colonial powers in their day. But not Switzerland! As such Switzerland showed respect for the integrity of other peoples from very early on in its history and is a country which is itself devoid of territorial ambitions.

Switzerland is also the home of the Red Cross, the movement set up by Henri Dunant, the initiator of humanitarian, innovative, and powerful new ideas which are of immense importance to people all around the world. The Swiss have a sense of beauty and aesthetic appreciation which shows itself in the attractive surroundings they create for themselves to live in. And, finally, Switzerland also has a great affinity with environmental protection – studies consistently show that Switzerland is the country with the greatest respect for the environment. In relation to the size of its population Switzerland has created more international companies than any other country in the world. Thanks to its universities, research institutions and industry, Switzerland is second to none in terms of research and innovative power.

The Swiss are quality conscious, for the most part they are as good as their word, and … our trains run on time, or at least they usually do. Other qualities, such as a sense of justice and our neutrality are also regarded as typical and positive Swiss characteristics by other countries. I don’t want to offend the modesty of the people listening to me here today too much and will refrain from extending this list of positive characteristics further. No doubt we also have our failings and I could, of course, also run through a list of negative aspects which the time at my disposal simply does not allow for – thank heavens!

With their positive features Swiss entrepreneurs – as becomes clear to us time and again when we are in other countries – play an exemplary role model function for others.

Globalization is all about the worldwide exchange of labor, capital, goods, and technologies as well as philosophies and ideas about environmental issues or international law. In other words, Swiss entrepreneurs must assume a leadership role and – based on the absolutely necessary reform of the Swiss financial sector – must propagate this role throughout the world.

The stock market and the global financial system are desperately in need of reform involving controls by equal partners with a pivotal role being played by entrepreneurs and representatives of industry. Entrepreneurs of all countries let us unite! Let us throw off our chains!

We cannot afford to go through eight major financial crises as we did during the last century! We are already in the midst of the first crisis of this new century – and a crisis which should by no means be underestimated!

All the entrepreneurs here today should realize – as I continually experience in all the numerous meetings and encounters I have with people every day in Switzerland and other countries – that in the current dangerous situation very many people are waiting for a liberating signal to come from Switzerland. Despite the massive subprime crisis we still have an absolutely intact Switzerland with an intact real economy, with industrious people, good entrepreneurs and companies – Nestlé, ABB, Swatch, Holcim, Fischer or Novartis and Roche and many more besides! We have one of the best managed national banks in the world and an excellent leadership at the SWX Swiss Exchange in Zurich which sees the important role the stock exchange is playing, and is still capable of dealing with these problems openly and rationally.

Let us provide them with the resources they need to concentrate with us on pushing through the necessary reforms! We all have a voice as powerful and capable representatives and entrepreneurs.

The Swiss Business Federation (economiesuisse) with its efficient management under the genuinely Swiss and entrepreneurial presidency of Gerold Bührer, shows a lucid and dynamic combative spirit. Our umbrella organization has very many strong members: the list is headed by Swissmem, which represents the mechanical and electrical engineering industries, the Federation of the Swiss Watch Industry, food and pharmaceutical associations and others. But also reputable journalists and analysts, engineers, professors, civil servants, bankers, lawyers and politicians are with us. Experience has shown that they are all among the very best in their respective fields.

Let’s work together to give the green light for reforms – first giving the signal in Switzerland and then, with an all-out effort from all of us, passing on the message around the whole world!

It’s time to show our capabilities, our leadership and will to renew ourselves to the people of Switzerland and beyond! The sovereign, our Swiss people, will fully support us in this task, of that I am convinced!

Switzerland has to assume its responsibility in the world again! You can all do your bit and make a real difference – and you can rest assured that I will also contribute my share to push things forward. That is the appeal I am making to all of you.

I wish everyone of us all the best and every success!