Ordinary General Meeting of Shareholders

Decisions taken by the Swatch Group shareholders at the Ordinary General Meeting of Tuesday, May 11, 2021

Biel/Bienne (Switzerland), May 11, 2021 - The Ordinary General Meeting of Shareholders has been held in accordance with Article 12 ff of the Articles of Association and Article 27 of the Ordinance 3 on Measures to Combat the Coronavirus (COVID-19) on Tuesday May 11, 2021 at 10:00 a.m., in Biel/Bienne, Switzerland. At today's Ordinary General Meeting, the shareholders approved, by a large majority, all proposals submitted by the Board of Directors.

Time to Spring

Like spring, Swatch stands for positive energy: a renewable one, a stream of lively creativity that allows even the driest branch to get to a new life.

From a season of confinement to a season of blooming ideas and new beauty.

We were confined but not immobile : the ticking heart of Swatch continues to generate new projects and evolve.

Time… is what we make of it!

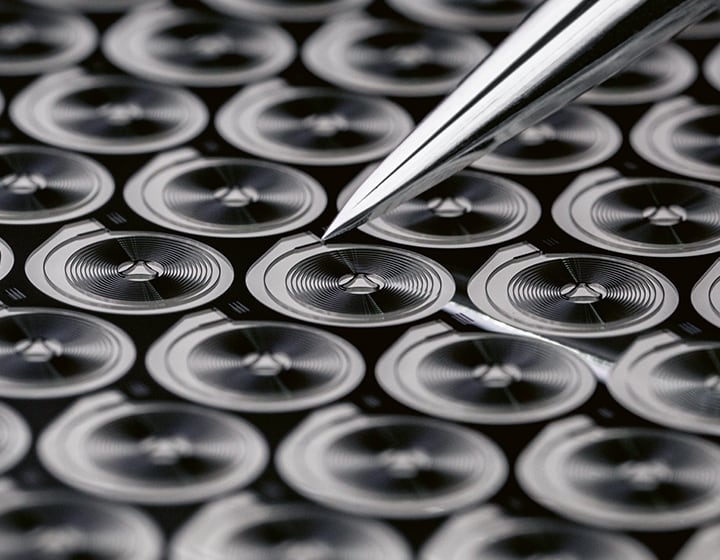

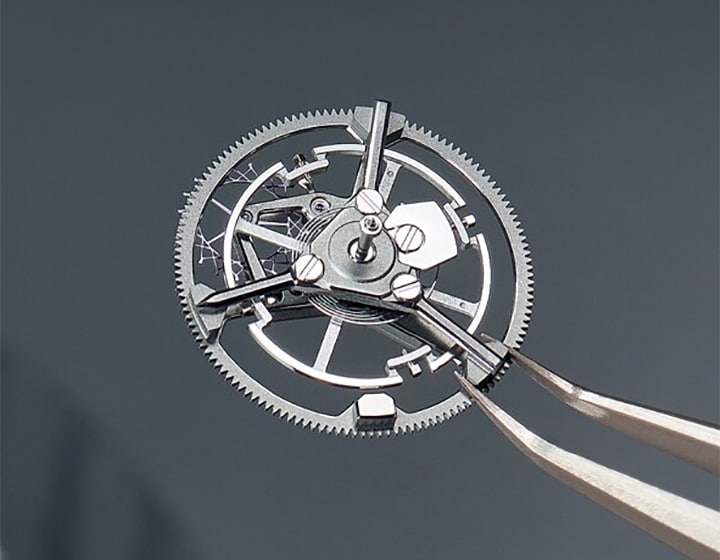

The dial of the 2021 shareholders’ watch is intentionally not centered, and only the branch on the upper part of the bracelet bears flowers, while none are to be found on the lower part.

Related news

Proposed appointment of Andreas Rickenbacher to the Board of Directors

Swatch Group will propose the appointment of Mr. Andreas Rickenbacher as a new member of its Board of Directors at the next Annual General Meeting, which takes place on May 12, 2026. This proposal is in line with the Group's desire to strengthen its governance and benefit from additional expertise within its Board of Directors. Andreas…

Key Figures 2025

Net sales of CHF 6 280 million, -1.3% at constant exchange rates compared to the previous year (-5.9% at current rates)1). Negative currency impacts of CHF 308 million. Excellent performance in the second half of the year with sales growth of 4.7% at constant exchange rates. Strong acceleration in the fourth quarter with sales up 7.2% worldwide…

Half-Year Report 2025

Net sales of CHF 3 059 million, -7.1% against the previous year at constant exchange rates and on a comparable basis1) (-10.4% at current rates). Negative currency impact of CHF -113 million. Operating profit of CHF 68 million (previous year: CHF 204 million). Operating margin of 2.2% (previous year: 5.9%). Net income of CHF 17 million (…