Half-Year Report 2022

- Net sales of CHF 3 612 million, +7.4% to the previous year at constant exchange rates, or +6.5% at current rates, despite sales losses of approximately CHF 400 million due to closures of warehouses and many retail stores in April and May in China.

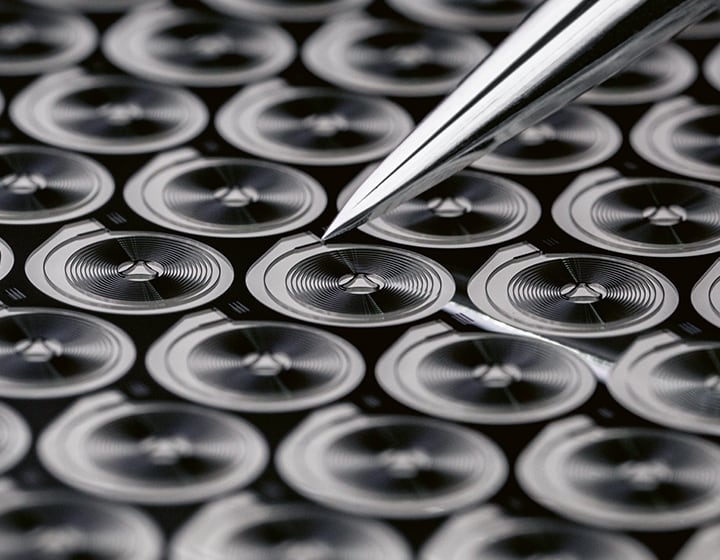

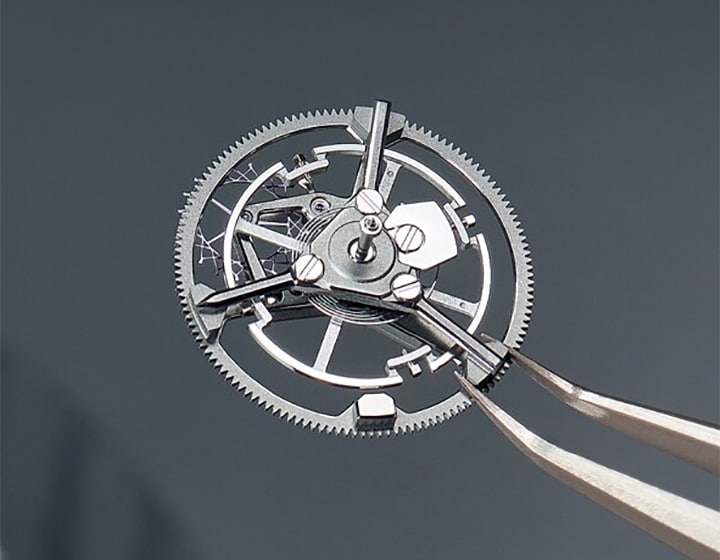

- The phenomenal success of the MoonSwatch for the Swatch brand as well as Omega underscores the strength of the Group’s verticalized production and the strategic importance of a presence in all price segments with strong brands.

- Operating profit of CHF 503 Mio, +25.1% to the previous year with CHF 402 million. Operating margin of 13.9% (previous year: 11.9%).

- Net income of CHF 320 million, +18.5% to the previous year with CHF 270 million.

Net margin of 8.9% (previous year: 8.0%). - Operating cash flow of CHF 287 million (previous year: CHF 519 million).

Free cash flow1) of CHF 139 million (previous year: CHF 421 million). - Net liquidity2) of CHF 2 397 million (previous year: CHF 1 975 million).

- Equity of CHF 11.7 billion (previous year: CHF 11.2 billion).

Equity ratio of 85.5% (previous year: 85.2%). - Excellent prospects in all segments with anticipated double-digit sales growth in local currencies for the entire year.

Outlook for the second half of 2022

Group Management is convinced that the goal of double-digit sales growth in local currencies for the entire year 2022 defined at the beginning of the year remains realistic. Growth prospects for all price segments, from Swatch to the prestige brands, are extremely positive. Regionally, the strongest growth in the second half of the year 2022 is expected in America, Asia and Mainland China. The production companies, and particularly the Electronic Systems segment will also contribute to the positive development.

1) Cash flow from operating activities minus cash flow from investing activities (without financial assets and securities)

2) Cash and cash equivalents as well as financial assets, securities and derivative financial instruments minus current financial debts and derivative financial liabilities

Related news

Proposed appointment of Andreas Rickenbacher to the Board of Directors

Swatch Group will propose the appointment of Mr. Andreas Rickenbacher as a new member of its Board of Directors at the next Annual General Meeting, which takes place on May 12, 2026. This proposal is in line with the Group's desire to strengthen its governance and benefit from additional expertise within its Board of Directors. Andreas…

Key Figures 2025

Net sales of CHF 6 280 million, -1.3% at constant exchange rates compared to the previous year (-5.9% at current rates)1). Negative currency impacts of CHF 308 million. Excellent performance in the second half of the year with sales growth of 4.7% at constant exchange rates. Strong acceleration in the fourth quarter with sales up 7.2% worldwide…

Half-Year Report 2025

Net sales of CHF 3 059 million, -7.1% against the previous year at constant exchange rates and on a comparable basis1) (-10.4% at current rates). Negative currency impact of CHF -113 million. Operating profit of CHF 68 million (previous year: CHF 204 million). Operating margin of 2.2% (previous year: 5.9%). Net income of CHF 17 million (…