Key Figures 2025

- Net sales of CHF 6 280 million, -1.3% at constant exchange rates compared to the previous year (-5.9% at current rates)1). Negative currency impacts of CHF 308 million.

- Excellent performance in the second half of the year with sales growth of 4.7% at constant exchange rates. Strong acceleration in the fourth quarter with sales up 7.2% worldwide and across all price segments.

- Operating profit of CHF 549 million (operating margin of 9.5%) in the Watches & Jewelry segment (excluding Production). Strongly negative operating result in the Production segment following the deliberate decision to maintain production capacities and jobs, without resorting to compensation for reduced working hours.

- Operating profit of CHF 135 million (previous year: CHF 304 million).

Operating margin of 2.1% (previous year: 4.5%). - Net profit of CHF 25 million (previous year: CHF 219 million).

Net margin of 0.4% (previous year: 3.3%). - Operating cash flow of CHF 507 million, +52.3% compared to the previous year.

Net liquidity2) of CHF 1 195 million (previous year: CHF 1 376 million). - Equity of CHF 11.7 billion. Equity ratio of 87.1%.

- Dividend proposal from the Board of Directors: CHF 0.90 per registered share (previous year: CHF 0.90) and CHF 4.50 per bearer share (previous year: CHF 4.50).

- The very positive momentum in the second half of the year, and the acceleration in the last quarter, continued in January 2026 for all price segments. The Group expects very positive sales and volume developments for 2026, giving the opportunity to massively reduce losses in the Production segment and substantially improve the Group’s profitability.

Outlook 2026

Considering the very positive momentum in the second half of 2025, with a strong acceleration in the fourth quarter – which continues in January 2026, the Group expects substantial growth for the year 2026 in all price segments. As a result, capacity utilization will improve significantly in the coming months and should massively reduce, or even help reverse, the negative result for the Production segment.

1) At the end of 2024, the Group transferred the Rivoli Group’s eyewear business to a new company in which it holds a minority stake. Unless otherwise stated, all changes in sales compared to the previous year are calculated excluding the transferred business.

2) Cash and cash equivalents as well as financial assets, securities and derivative financial instruments minus current financial debts and derivative financial liabilities

Related news

Proposed appointment of Andreas Rickenbacher to the Board of Directors

Swatch Group will propose the appointment of Mr. Andreas Rickenbacher as a new member of its Board of Directors at the next Annual General Meeting, which takes place on May 12, 2026. This proposal is in line with the Group's desire to strengthen its governance and benefit from additional expertise within its Board of Directors. Andreas…

Half-Year Report 2025

Net sales of CHF 3 059 million, -7.1% against the previous year at constant exchange rates and on a comparable basis1) (-10.4% at current rates). Negative currency impact of CHF -113 million. Operating profit of CHF 68 million (previous year: CHF 204 million). Operating margin of 2.2% (previous year: 5.9%). Net income of CHF 17 million (…

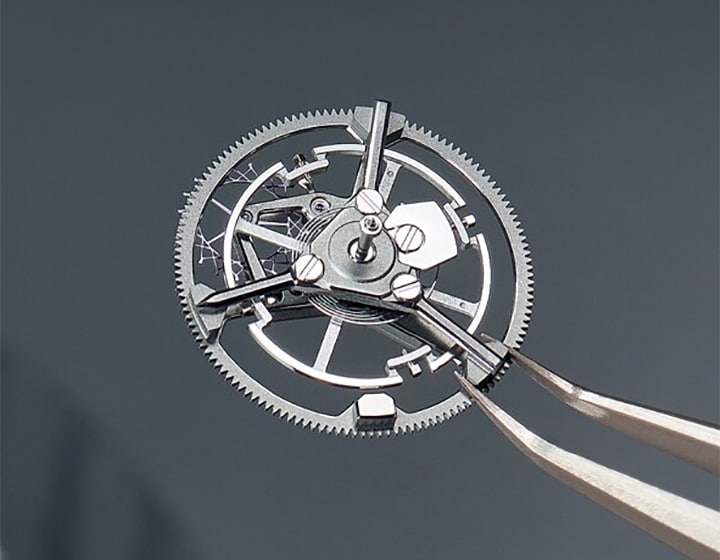

Apprenticeship graduation

Congratulations to our apprentices for their successful apprenticeship graduation! The companies and brands of the Swatch Group Blancpain, CHH Microtechnique, Comadur, Dress your body, EM Microelectronic-Marin, ETA, Glashütte Original, Longines, Manufacture Ruedin, Montres Breguet, Nicolas G. Hayek Watchmaking School Pforzheim, Nivarox-FAR, Omega…