Swatch Group acquires Simon Et Membrez SA

The Swatch Group Ltd is acquiring 100% of the shares of Simon Et Membrez SA in Delémont. The shares are currently owned by Philippe Membrez, the company’s CEO, and Etienne Membrez and Didier Membrez. In addition, Swatch Group is also acquiring the related 60% holding in Termiboîtes SA (case polishing) in Courtemaîche that counts 50 employees.

Simon Et Membrez SA is a seamless fit alongside the existing Swatch Group production companies and logically complements Comadur, Manufacture Ruedin and Lascor, the companies active in the production of watch casings within the Swatch Group.

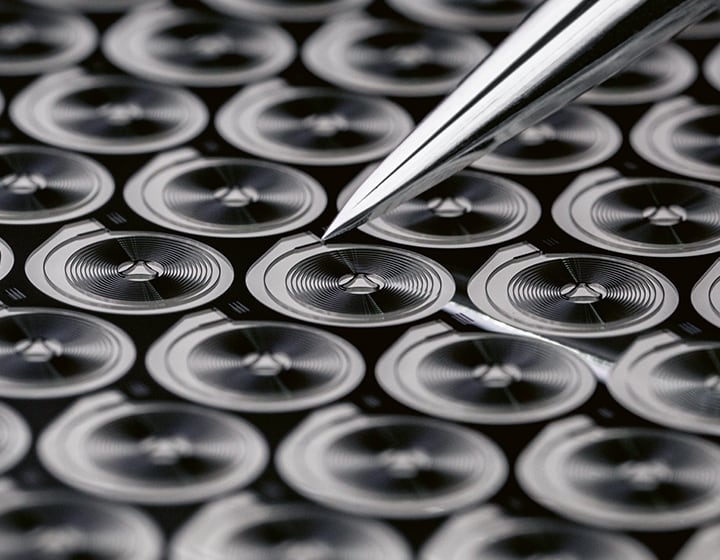

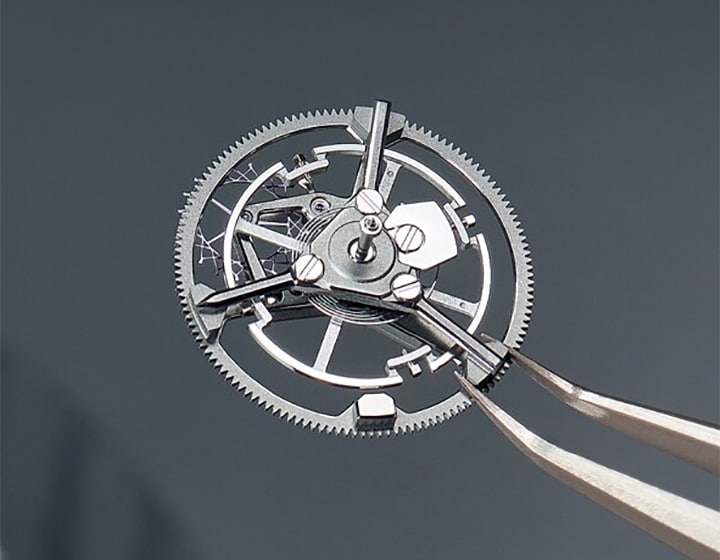

Simon Et Membrez SA manufactures high quality watch cases for the top price segment out of precious materials such as gold, titanium, platinum, palladium and premium-quality steels. Swatch Group has a long-standing business relationship with Simon Et Membrez SA for a number of its watch brands (Breguet, Blancpain). Simon Et Membrez SA will continue to supply third parties.

With its 250 employees the company will continue to trade under the Simon Et Membrez name, as Philippe Membrez and his team will continue to be responsible for business operations. In its new plant in Delémont, the company has an ultra-modern machinery pool and works with the most advanced technologies, which meet the quality requirements of its clients and demonstrate environmental awareness (ISO 9001 and ISO 14001 certified). Simon Et Membrez SA was created in 1975 in Delémont by René Simon and Etienne Membrez, the father of the current CEO. The new plant in Delémont was inaugurated in the summer of 2008 and expanded to its current size in 2011.

Related news

Proposed appointment of Andreas Rickenbacher to the Board of Directors

Swatch Group will propose the appointment of Mr. Andreas Rickenbacher as a new member of its Board of Directors at the next Annual General Meeting, which takes place on May 12, 2026. This proposal is in line with the Group's desire to strengthen its governance and benefit from additional expertise within its Board of Directors. Andreas…

Key Figures 2025

Net sales of CHF 6 280 million, -1.3% at constant exchange rates compared to the previous year (-5.9% at current rates)1). Negative currency impacts of CHF 308 million. Excellent performance in the second half of the year with sales growth of 4.7% at constant exchange rates. Strong acceleration in the fourth quarter with sales up 7.2% worldwide…

Half-Year Report 2025

Net sales of CHF 3 059 million, -7.1% against the previous year at constant exchange rates and on a comparable basis1) (-10.4% at current rates). Negative currency impact of CHF -113 million. Operating profit of CHF 68 million (previous year: CHF 204 million). Operating margin of 2.2% (previous year: 5.9%). Net income of CHF 17 million (…