Half-Year Report 2013

Further growth in both sales and profit

- The Group’s gross sales were up 8.7% to CHF 4 181 million, versus the very strong figures recorded in the first half of 2012.

- Benchmarked to the 1.5% export growth for wrist watches of the Swiss watch industry in the first half of 2013, the segment Watches & Jewelry (now including Production) growth was more than 9%.

- Compared to the end of 2012, headcount increased by more than 1150, of which 560 in Switzerland, to 31 000 worldwide.

- An operating profit of CHF 910 million was recorded, with an operating margin of 22.7%, despite a high marketing spend, important investments in innovative and revolutionary products and production methods, and the integration of Harry Winston.

- Net income increased by 6.1% compared to the first half of 2012 to CHF 768 million, with a 19.2% return on net sales.

- Sustained growth experienced in all regions.

- Positive outlook for a strong second half of 2013.

Group overview

The global leader in the watch industry, with its brand portfolio now containing 20 brands, grew by a further 8.7%, generating gross sales of CHF 4 181 million in the first half of 2013. Positive growth in Swiss francs was once again recorded on every continent as compared with the very strong first half year 2012. The integration of Harry Winston will only really become noticeable in the second half of 2013. The first half of the year saw fluctuating currency development, which had only a slightly positive effect of +1% on Group sales. From the start of the year, the Swiss franc strengthened further against the yen and the British pound, while the correction in the US dollar and euro was only slightly positive against our overly strong national currency.

The Watches and Jewelry segment, which now also includes production activities, continued to remain the growth driver and recorded a year-on-year increase of 9.1% in the first half of 2013. This growth was driven primarily by our watch and jewelry brands. A great deal of investment has been plowed into the marketing activities of all of the brands, ranging from investment in new groundbreaking innovations to investment relating to the redesign of booths for the Watches and Jewelry Fair Basel.

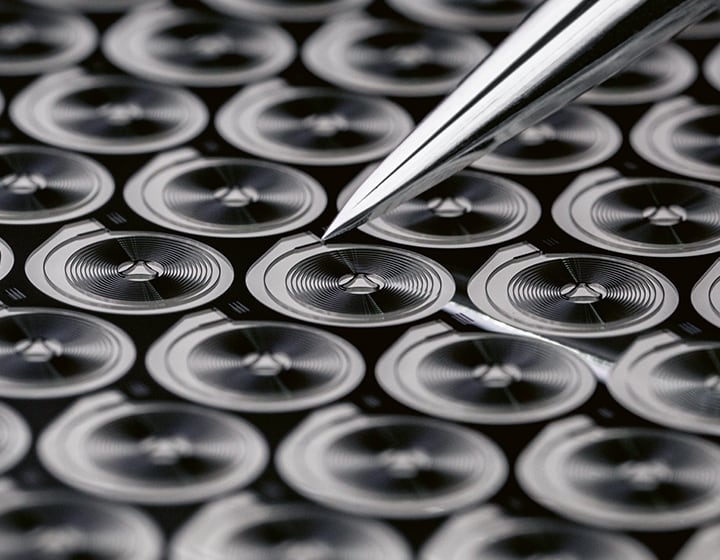

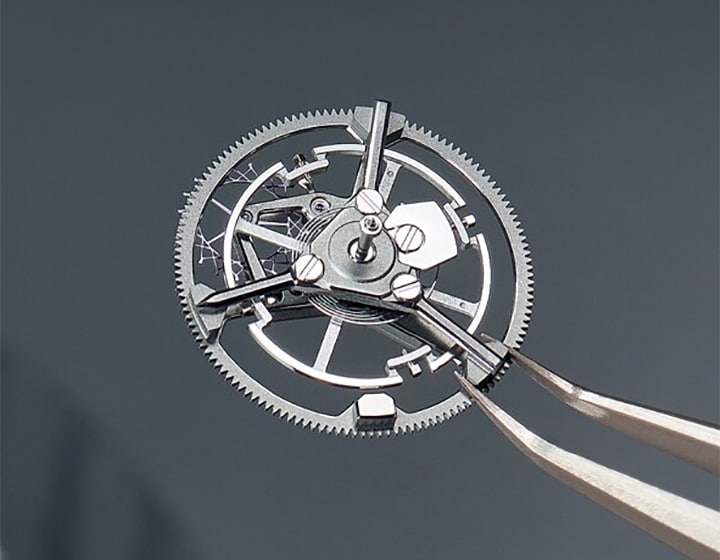

The Swatch brand attended Baselworld for the first time and showcased the entire collection developed over its 30-year history. The anniversary was celebrated with the launch of the new mechanical Swatch «Sistem 51», featuring a completely new mechanical watch movement, which is made up of just 51 components including a unique central screw and boasts a power reserve of 90 hours. The challenge of 1983, i. e. the manufacture of a quartz watch using just 51 components, has been topped in the mechanical sector, thus ensuring the unique positioning of the Swatch brand. With this extraordinary advance in watch technology, the Group sets new, unprecedented standards in the simplification of mechanical watches. 17 new patents have been registered for this groundbreaking innovation alone.

The acquisition of the Harry Winston brand did more than simply round off the Group’s already broad brand portfolio; it also expanded the High Jewelry segment, along with the segment’s value chain from production up to and including the retail network. This infrastructure was also provided with the investment required to better utilize the huge potential offered by the brand and its organization. Furthermore, in the first few months following the acquisition, all debts were settled, the equity capital base expanded and, during this process, the inventory was also immediately increased. The latter was initiated in order to ensure that our clientele has access to the best selection of jewelry as well as to increase its availability. As the name Harry Winston is synonymous with the finest high jewelry featuring the most beautiful diamonds, in May we invested in the singular, largest and purest diamond in the world to date. This 101.73-carat diamond now bearing the name «Winston Legacy» was acquired for USD 26.7 million and reconfirms the number one position of this high jewelry brand. The Harry Winston brand also has an extremely large and almost untapped potential in the watch sector, which the Group now aims to expand further using its experience around the world. The necessary funds will also be invested into this activity.

As the brands work very closely with or are even completely integrated with specific manufacturers and production units with Swatch Group, e.g. Breguet or Blancpain, and now also with Harry Winston, it is becoming increasingly difficult to view Production as a separate segment. Therefore, the Group decided to fully integrate the Production segment into the Watches & Jewelry segment. This integration will also provide a more uniform view of activities, facilitating comparability with our competitors. The conversion of production processes and from MRP II (Manufacturing Resource Planning) systems to SAP, which was carried out in the first half of the year, put a strain – albeit only for a short period of time – on production productivity. However, this provided us with the prerequisites for the further growth strategy within production. Thanks to the motivated teams that worked on these projects, these conversions were completed within a few months. With full order books in production and new operations being brought up to speed with the updated MRP II systems, a stronger second half-year is expected.

The Electronic Systems segment continues to remain directly exposed to the USD to CHF exchange rate, and now also to the JPY, which has dropped 9.8% against the CHF in this reporting period alone. Despite the continuing negative impact of the appreciation of our national currency, this segment was able to achieve gross sales of CHF 149 million, which represents a drop of 6.9% at current exchange rates.

Under the external conditions mentioned above and bearing in mind the traditionally reserved price adjustment policy, the Group generated an operating profit of CHF 910 million and a net income of CHF 768 million. In addition to the acquisition of the Harry Winston brand, the Group also invested a further CHF 295 million in the distribution network and production, particularly in machinery and equipment for the newly launched production units in Switzerland which have been brought into operation. The increase in size of the inventory can mainly be attributed to the integration of Harry Winston. Despite all of the investments mentioned and the conversions carried out in production, an operating cash flow totaling CHF 675 million was realized, compared to CHF 256 million in the prior year period.

Outlook

The outlook for the Group remains very promising, and a strong second half-year is expected. The highlights of the second half of the year are, among others, the launch of the Omega Seamaster Aqua Terra >15 000 Gauss, the world’s first real antimagnetic watch, as well as the Swatch «Sistem 51» which will be available on the market from November. The continued integration of the Harry Winston brand will also make a significant contribution, as this brand has huge, almost untapped market potential in the high jewelry and watches activities.

Related news

Proposed appointment of Andreas Rickenbacher to the Board of Directors

Swatch Group will propose the appointment of Mr. Andreas Rickenbacher as a new member of its Board of Directors at the next Annual General Meeting, which takes place on May 12, 2026. This proposal is in line with the Group's desire to strengthen its governance and benefit from additional expertise within its Board of Directors. Andreas…

Key Figures 2025

Net sales of CHF 6 280 million, -1.3% at constant exchange rates compared to the previous year (-5.9% at current rates)1). Negative currency impacts of CHF 308 million. Excellent performance in the second half of the year with sales growth of 4.7% at constant exchange rates. Strong acceleration in the fourth quarter with sales up 7.2% worldwide…

Half-Year Report 2025

Net sales of CHF 3 059 million, -7.1% against the previous year at constant exchange rates and on a comparable basis1) (-10.4% at current rates). Negative currency impact of CHF -113 million. Operating profit of CHF 68 million (previous year: CHF 204 million). Operating margin of 2.2% (previous year: 5.9%). Net income of CHF 17 million (…