Swatch Group: Key Figures 2010

Swatch Group: Key Figures 2010

Biel / Bienne (Switzerland), February 8, 2011

- Record gross sales of CHF 6 440 million despite negative currency effects of CHF 164 million or –3% versus 2009 (CHF 285 million or –4.7% versus 2008; CHF 596 million or –10% versus 2007).

- Record operating profit ofCHF 1 436 million, with an operating margin of 23.5% (versus 17.6% in 2009).

- Net income of CHF 1 080 million, representing an increase of 41.5% on 2009 and of 6.4% on the record year of 2007, despite currency losses.

- Substantial equity of CHF 7.1 billion or 82.4% of total balance sheet (versus 77.6% in 2009).

- Proposed dividend increase of 25%, CHF 5.00 per bearer share (2009: CHF 4.00) and CHF 1.00 per registered share (2009: CHF 0.80).Promising start to 2011; prospects remain good for the year as a whole, despite the current strength of the Swiss Franc.

Outlook for 2011

The strong uptrend seen in 2010 was confirmed again in January 2011. The current outlook for 2011 appears positive, despite the unfavorable currency constellation at present, particularly the US Dollar and the Euro against the Swiss Franc. The Board of Directors and Executive Group Management Board of the Swatch Group will continue to pursue a clear and healthy organic growth strategy in this very positive environment, with the objective of achieving sales of ten billion Swiss Francs in the medium term.

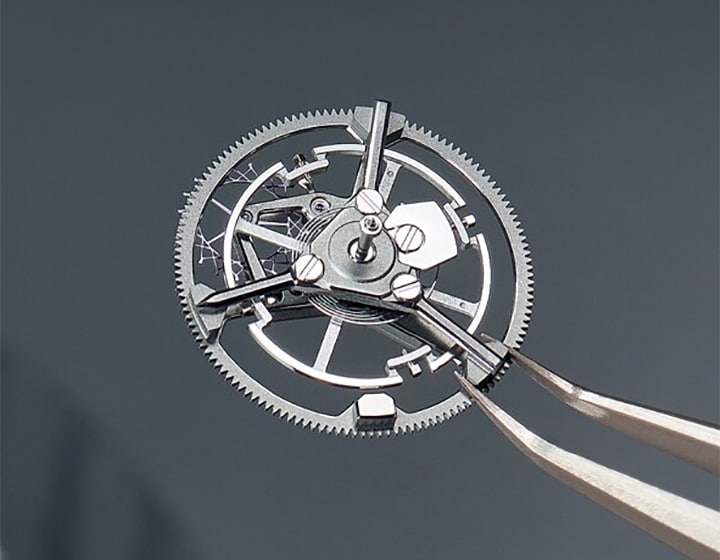

Thanks to very motivated employees, the strong geographic presence of the brands in all of the world’s major markets and its comprehensive coverage of all market price segments, the Group is optimally placed to achieve this goal. In addition, further investments in research and development will generate innovations and products, which can be introduced to the public on an ongoing basis, some as soon as this year’s trade fair in Basel. To ensure the continuation of the Group’s sustainable growth, further targeted investments will be made in the already comprehensive and efficient distribution network and, as already mentioned, in the expansion of production capacities. Thanks to its very solid starting point as regards equity and liquidity, the Group will be able to exploit interesting opportunities to increase its market share and presence.

Related news

Proposed appointment of Andreas Rickenbacher to the Board of Directors

Swatch Group will propose the appointment of Mr. Andreas Rickenbacher as a new member of its Board of Directors at the next Annual General Meeting, which takes place on May 12, 2026. This proposal is in line with the Group's desire to strengthen its governance and benefit from additional expertise within its Board of Directors. Andreas…

Key Figures 2025

Net sales of CHF 6 280 million, -1.3% at constant exchange rates compared to the previous year (-5.9% at current rates)1). Negative currency impacts of CHF 308 million. Excellent performance in the second half of the year with sales growth of 4.7% at constant exchange rates. Strong acceleration in the fourth quarter with sales up 7.2% worldwide…

Half-Year Report 2025

Net sales of CHF 3 059 million, -7.1% against the previous year at constant exchange rates and on a comparable basis1) (-10.4% at current rates). Negative currency impact of CHF -113 million. Operating profit of CHF 68 million (previous year: CHF 204 million). Operating margin of 2.2% (previous year: 5.9%). Net income of CHF 17 million (…